In this article, we will provide an authoritative guide on what crypto wallets are, why they are indispensable, and the various types available to users. We will also cover how to use crypto wallets, and a step-by-step guide to choosing a crypto wallet development company.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, manage, and transact cryptocurrencies securely. Unlike traditional wallets, crypto wallets do not store physical currency but rather the private and public keys needed to access and manage one's digital assets. These keys are crucial for performing transactions on the blockchain, the decentralized ledger that underpins all cryptocurrency activities.

Crypto wallets come in two main forms: software wallets and hardware wallets. Software wallets are applications or programs that can be accessed via a computer or smartphone, while hardware wallets are physical devices that store keys offline, providing an extra layer of security against cyber threats.

Why Do You Need Crypto Wallets?

Crypto wallets are essential for several reasons:

1. Security

They protect your digital assets from unauthorized access and cyber-attacks. With the rise of hacking incidents, using a secure wallet is paramount to safeguarding your investments.

2. Ownership

Unlike keeping funds on an exchange, a crypto wallet ensures that you have full control over your private keys, and thus, your cryptocurrencies. This reduces the risk associated with third-party custodians.

3. Convenience

Crypto wallets streamline the process of sending and receiving cryptocurrencies. They often come with user-friendly interfaces that make transactions straightforward.

4. Diverse Functionality

Many modern wallets support a variety of cryptocurrencies and offer additional features such as portfolio tracking, staking, and integration with decentralized applications (dApps).

Types of Crypto Wallets

Crypto wallets can be broadly categorized into two types: hot wallets and cold wallets.

1. Hot Wallets

Hot wallets are connected to the internet, making them convenient for frequent transactions. They are ideal for users who trade regularly or need quick access to their funds. However, their constant connection to the internet makes them more vulnerable to cyber-attacks and security breaches. Despite these risks, their ease of use and accessibility make them popular choices for everyday transactions.

Examples of hot wallets include:

a) Web Wallets

Accessible through web browsers, these wallets offer convenience and quick access. They rely on the security measures of the service provider, which can be a downside if the provider is compromised.

b) Mobile Wallets

These are apps installed on smartphones, providing easy access to funds on the go. They often feature additional functionalities like QR code scanning for transactions. However, they are also susceptible to malware and phishing attacks.

c) Desktop Wallets

Installed on a personal computer, these wallets strike a balance between security and convenience. They are generally more secure than web and mobile wallets but can still be compromised if the computer is infected with malware.

2. Cold Wallets

Cold wallets, on the other hand, are not connected to the internet, making them significantly more secure against online threats. They are ideal for long-term storage of cryptocurrencies, often referred to as "cold storage." These wallets protect your digital assets from cyber-attacks, as they remain offline and thus inaccessible to hackers.

Examples of cold wallets include:

a) Hardware Wallets

Physical devices that store private keys offline, providing the highest level of security. They are resistant to malware and are considered the best option for safeguarding large amounts of cryptocurrency.

b) Paper Wallets

A paper wallet is a physical document containing your private and public keys. While highly secure against online threats, they require careful handling and storage to avoid loss or damage.

c) Offline Software Wallets

Also known as air-gapped wallets, these are software wallets used on devices that never connect to the internet. They offer robust security but can be complex to set up and use.

Choosing between hot and cold wallets depends on your specific needs. For frequent transactions and quick access, hot wallets are suitable, albeit with increased security risks. For long-term storage and maximum security, cold wallets are the preferred choice, providing peace of mind and protection against cyber threats.

How to Use a Crypto Wallet

Using a crypto wallet involves a few fundamental steps, regardless of the type of wallet chosen. Here's a basic guide:

1. Set Up

After selecting a wallet, download the software or configure the hardware device. Follow the instructions to set up your wallet, which usually involves creating a new wallet and securely backing up your private keys or seed phrase.

2. Secure Your Wallet

Ensure that your wallet is protected with a strong password and, where possible, enable two-factor authentication (2FA). For hardware wallets, keep the device in a safe place.

3. Fund Your Wallet

Obtain your wallet's public address and use it to receive cryptocurrency. You can transfer funds from an exchange or another wallet by inputting this address in the "send" field.

4. Send and Receive Crypto

To send cryptocurrency, enter the recipient's address and the amount you wish to send in your wallet's interface. For receiving, provide your public address to the sender.

5. Track Your Transactions

Most wallets provide transaction histories and balance tracking features. Regularly monitor your wallet to stay updated on your transactions and holdings.

6. Update Software

Keep your software wallet and any associated applications up-to-date to benefit from the latest security enhancements and features.

Top Crypto Wallet Tokens

Several tokens are specifically designed for or integrated with crypto wallets, enhancing their functionality and security. Some of the notable crypto wallet tokens include:

1. Tether (USDT)

Widely used for trading and transfers, it offers stability as a stablecoin.

2. Bitcoin (BTC)

The most recognized cryptocurrency, supported by almost all wallets.

3. Ethereum (ETH)

Essential for interacting with decentralized applications and smart contracts.

4. Cardano (ADA)

Known for its strong security and scalability features.

5. Polkadot (DOT)

Facilitates cross-chain transfers and supports various cryptocurrencies.

Crypto Wallet Development Steps

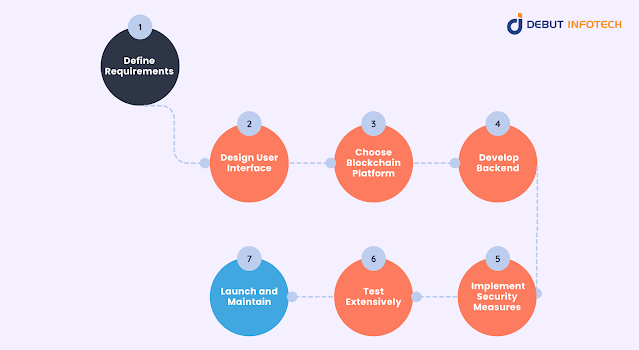

Developing a decentralized cryptocurrency wallet involves several critical steps to ensure functionality, security, and user-friendliness. Here’s a simplified overview:

1. Define Requirements

Determine the wallet’s purpose, supported cryptocurrencies, and key features (e.g., multi-currency support, QR code scanner, exchange integration).

2. Design User Interface

Create a user-friendly and intuitive interface. This includes designing screens for wallet creation, transactions, balance viewing, and settings.

3. Choose Blockchain Platform

Decide which blockchain(s) the wallet will support. Common choices include Bitcoin, Ethereum, and others based on user needs.

4. Develop Backend

Set up the server infrastructure and backend services to handle transactions, manage user accounts, and ensure secure communication with the blockchain.

5. Implement Security Measures

Integrate robust security protocols such as encryption, two-factor authentication, and secure key management. Regularly update and audit security practices to protect against vulnerabilities.

6. Test Extensively

Conduct thorough testing to identify and fix bugs. This includes functional testing, security testing, and usability testing to ensure a seamless user experience.

7. Launch and Maintain

After successful testing, launch the wallet and monitor its performance. Provide ongoing support and updates to address any issues and incorporate new features.

Factors to Consider When Choosing Crypto Wallet Development Services

When selecting a development service for your decentralized crypto wallet, consider the following factors:

1. Experience and Expertise

Choose a service provider with a proven track record in blockchain and crypto wallet development. An experienced cryptocurrency wallet app development company will understand the complexities and best practices involved.

2. Security Protocols

Ensure the developer prioritizes security and follows industry standards to protect users' assets and data.

3. Customization and Flexibility

The development service should offer customizable solutions to meet your specific requirements and be flexible enough to adapt to evolving needs.

4. Support and Maintenance

Reliable post-launch support and regular maintenance are crucial for the long-term success and security of your wallet.

5. Cost and Timeline

Evaluate the cost and development timeline to ensure it aligns with your budget and project schedule. Transparency in pricing and deadlines is important.

Conclusion

Crypto wallets are indispensable tools for anyone involved in the world of cryptocurrency, offering security, control, and convenience. By understanding the different types of wallets and their functionalities, users can make informed decisions about how to manage their digital assets. For businesses looking to develop a crypto wallet, selecting the right cryptocurrency development services is crucial to ensuring a secure and user-friendly product.

Debut Infotech is a leading cryptocurrency wallet development company, renowned for delivering secure, innovative, and customizable wallet solutions. With extensive experience in blockchain technology and a commitment to excellence, Debut Infotech provides top-tier services to meet your specific needs. Choose Debut Infotech for reliable, cutting-edge crypto wallet development that empowers your digital financial journey.

.png)